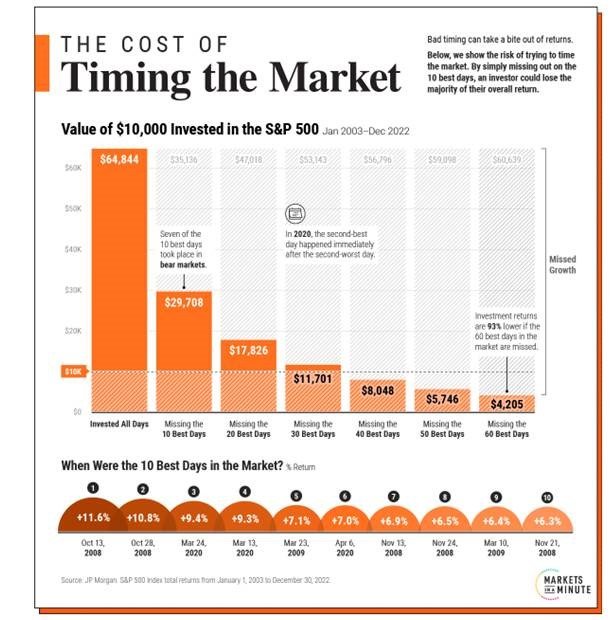

Timing the market: Why it’s so hard in one chart.

Timing the market seems simple enough: buy when prices are low and sell when they’re high.

But there is clear evidence that market timing is difficult. Often, investors will sell early, missing out on a stock market rally. It can also be unnerving to invest when the market is flashing red. This is indeed a major part of the problem; market timing involves making not just one very tricky decision but two; when do I come out of the market? And when do I go back in? If an investor comes out of the market and the market falls further, he/she can congratulate themselves on their timing BUT unless he/she goes back into the market still at a price lower than when they came out, the exercise will have been counterproductive. I often hear people say, ‘I’ll wait for the market to settle down before I invest’, but it is this ‘settling down’ that is usually the market recovering and as the chart shows, you really don’t want to miss that.

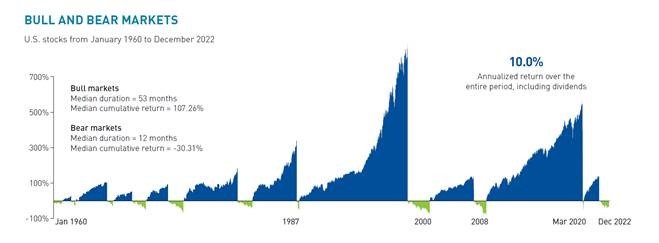

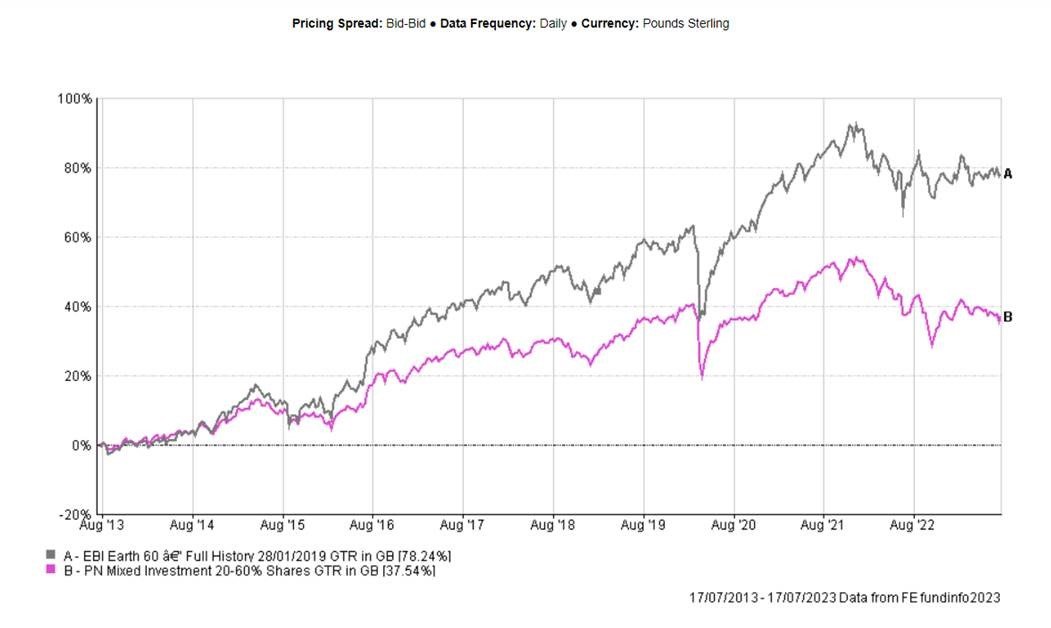

By contrast, staying invested through highs and lows has generated attractive returns, especially over longer periods.

The above graphic shows how trying to time the market can take a bite out of your portfolio value, using 20 years of data from JP Morgan.

The Pitfalls of Timing the Market

Mistiming the market even by just a few days can significantly affect an investor’s returns.

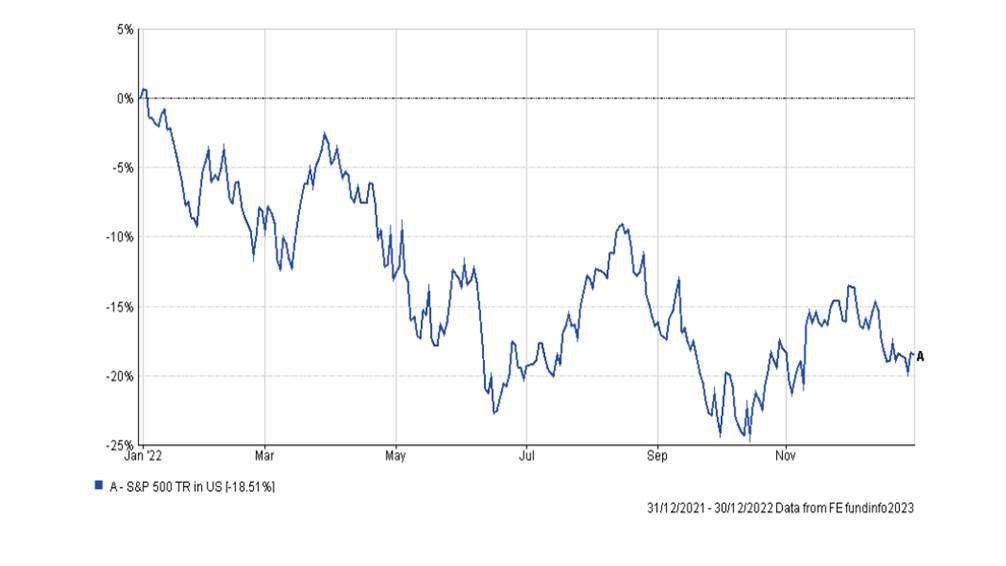

The following scenarios compare the total returns of a $10,000 investment in the S&P 500 between January 1, 2003 and December 30, 2022. Specifically, it highlights the impact of missing the best days in the market compared to sticking to a long-term investment plan.

As we can see in the above table, the original investment grew over sixfold if an investor was fully invested for all days.

If an investor were to simply miss the 10 best days in the market, they would have shed over 50% of their end portfolio value. The investor would finish with a portfolio of only $29,708, compared to $64,844 if they had just stayed put.

Making matters worse, by missing 60 of the best days, they would have lost a striking 93% in value compared to what the portfolio would be worth if they had simply stayed invested.

Overall, an investor would have seen almost 10% in average annual returns using a buy-and-hold strategy. Average annual returns entered negative territory once they missed the 40 best days over the time frame.

The Best Days in the Market

Why is timing the market so hard? Often, the best days take place during bear markets.

Over the last 20 years, seven of the 10 best days happened when the market was in bear market territory.

Adding to this, many of the best days take place shortly after the worst days. In 2020, the second-best day fell right after the second-worst day that year. Similarly, in 2015, the best day of the year occurred two days after its worst day.

Interestingly, the worst days in the market typically occurred in bull markets.

Why Staying Invested Benefits Investors

As historical data shows, the best days happen during market turmoil and periods of heightened market volatility. In missing the best days in the market, an investor risks losing out on meaningful return appreciation over the long run.

Not only does timing the market take considerable skill, it involves temperament, a consistent track record and more than a little luck. If there were bullet-proof signals for timing the market, they would of course be used by everyone.

I know how tempting it can be to look for a new strategy when the current one doesn’t appear to be working but, this is the very time to stay strong and look at the bigger picture, the evidence is clear, staying fully invested is the best option in the long run.

I hope you have found this interesting but, if you have any questions about this piece or any other finance related matter, please do not hesitate to get in touch.

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner