Today marks the 30th anniversary of the stock market crash that became known as Black Monday. The FTSE 100 fell 10.84% on October 19th and then fell a further 12.22% the following day. That event marked the beginning of a global stock market decline, making Black Monday one of the most notorious days in financial history. By the end of the month, most major global stock exchanges had dropped more than 20%.

The cause of the massive drop cannot be attributed to any single news event because no major news event was released on the weekend preceding the crash. While there are many theories that attempt to explain why the crash happened, including massively increased automated trading following ‘Big Bang’ the year before, most agree that mass panic caused the crash to escalate.

The following chart shows how the FTSE 100 Index performed from mid-July 1987 to the end of that year.

An investor with £100,000 invested in the FTSE in July would have seen their funds drop to £72,120 over that period, most of the fall occurring in the first few days after October 19th. If we look at the whole of 1987 however, the picture is not quite as bleak.

The main problem, as I recall, was that this was the time of a number of privatisations and many novice investors had been taking their very first, government assisted, foray into equity investing. As usual, long-term investors who were already in the market at the beginning of 1987 did not really suffer at all but those who piled in during the summer of that year took the full force of the crash; most sold in blind panic. Many never recovered from this shock and refused to go near shares again, a decision which, over the ensuing decades, will have cost them dear.

Now let’s look at how long an investor would have needed to wait to recover their money if they had invested at the peak of the market in mid-July 1987.

Not quite 2 years! Again, as usual, long-term investors were rewarded for their patience and those who managed to find some cash down the back of the sofa and had the courage to invest in November/December of 1987, did even better.

What lessons can we learn from Black Monday and other market crashes?

Unless it is absolutely the end of the world, a market crash of any duration is temporary. Many of the steepest market rallies have occurred immediately following a sudden crash. The steep market declines in August 2015 and January 2016 were both 10% drops, but the market fully recovered and rallied to new or near new highs in the months following.

This is the bit where I sound like a stuck record.

Stick with your strategy: A well-conceived, long-term investment strategy based on personal investment objectives should provide the confidence needed to stay cool while everyone else is panicking. Investors who lack a strategy tend to let their emotions guide their decision-making. Investors who have stayed invested in the Standard & Poor’s 500 Index since 1987 have earned an annualized return of 10.13%.

Buy on Fear: Knowing that market crashes are only temporary, it should be viewed as a moment of opportunity to buy stocks or funds. Market crashes are inevitable; buy while others are selling.

Turn Off the Noise: Over the long term, market crashes such as Black Monday show up as a small blip in the performance of a well-structured portfolio. Short-term market events are impossible to predict, and they are soon forgotten. Long-term investors are better off turning off the noise of the media and the herd, and focusing on their long-term objectives. We are here to help with this!

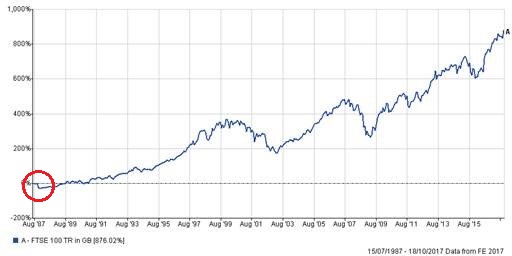

This next chart of the FTSE 100, starts in mid-July 1987 and finishes at close of play yesterday. This makes the point from the paragraph above, Black Monday 1987 is barely visible, when viewed from where we are now.

I hope you find this brief analysis interesting, possibly even reassuring but, as always, if you have any concerns or questions about any finance related matter, please do not hesitate to call me at any time.

With best wishes,

Yours sincerely

Graham Ponting CFP Chartered MCSI

Managing Partner