For millions of people across the UK, “playing it safe” means keeping their money in cash. It feels sensible. It feels secure. And in uncertain times, it feels comforting.

But the uncomfortable truth is this: over the long term, cash quietly makes you poorer.

New research from Scottish Friendly reveals just how widespread this problem has become.

The survey found that 42% of adults keep all their wealth in cash, with another 15% holding most of it there.

That means well over half of adults are largely opting out of investing altogether.

Even more striking, 72% admit they know this could leave them worse off in the long run.

So why do it?

The main reasons are emotional, not rational:

Quick access to money – 39%

Fear of losses – 38%

Distrust of markets – 34%

In other words, people understand the risks of cash. But fear is winning.

What the Numbers Really Show

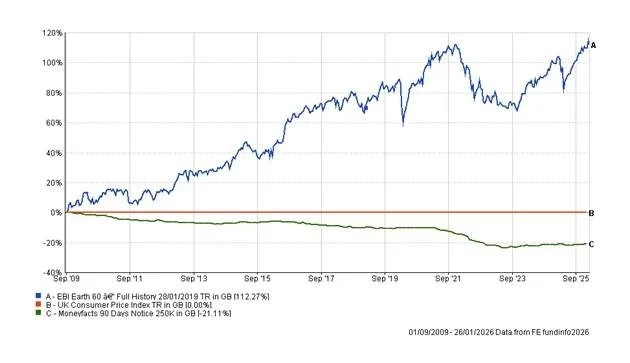

The chart below tells the story more clearly than words ever could. It compares:

A balanced investment portfolio (blue)

Cash (green)

Inflation, measured by CPI (flat orange line, set as the baseline)

Inflation is shown as flat because all figures are measured relative to it. Anything below that line is losing purchasing power.

Look closely at what happens over time, 20 years in this example.

The blue line — representing a diversified, balanced portfolio — rises steadily, despite short-term dips. It reflects growth that comfortably outpaces inflation.

The green line — cash — drifts downward.

That is inflation at work.

Even when cash “feels” safe, it is quietly being eroded. Every year, your money buys a little less. Over decades, that erosion becomes devastating.

This is the hidden cost of caution.

The Illusion of Safety

Kevin Brown, savings specialist at Scottish Friendly, describes the problem perfectly:

“People in the main understand the risks of keeping their savings in cash over the long term but they nonetheless cannot make the leap to invest… The result is they are making themselves poorer.”

This is what he calls the “mental gymnastics” of savers.

We tell ourselves:

“At least it’s safe.”

“I can access it anytime.”

“I don’t want to lose money.”

But inflation means you are losing money anyway — just slowly and silently.

It doesn’t show up as a headline loss.

It doesn’t trigger panic.

It just eats away at your future.

Who Is Most Affected?

The research also reveals stark generational differences.

56% of Baby Boomers hold all their wealth in cash

44% of Gen X

25% of Millennials

21% of Gen Z

Older generations are the most cautious — and the most exposed to inflation risk.

Distrust of markets is highest among Boomers (40%), compared with just 23% of Gen Z.

Fear of losses is also more pronounced among women (44% vs 33% of men).

Millennials, interestingly, are the most likely to “half-step” — investing some money, but still keeping most in cash (18%).

Across all groups, the same theme emerges: fear outweighs evidence.

Investing Isn’t Reckless — It’s Responsible

One of the biggest misconceptions is that investing equals gambling.

It doesn’t.

Proper investing means:

Diversifying your money

Spreading risk

Staying invested for the long term

Accepting short-term ups and downs for long-term gain

As the chart shows, markets fluctuate. There are dips. Sometimes sharp ones.

But over time, well-constructed portfolios have consistently beaten inflation.

Cash, on the other hand, almost never does.

So the real gamble is not investing.

The real risk is standing still while prices rise.

The Wider Cost to Britain

This isn’t just a personal issue. It affects the entire economy.

When millions of people keep their wealth in cash:

UK businesses struggle to access capital

Innovation slows

Growth is stifled

Productivity suffers

As Brown warns:

“This also affects the economy, leaving domestic companies short of the capital they need to grow.”

A nation that only saves cannot thrive.

A nation that invests builds its future.

A Better Way Forward

You don’t have to choose between recklessness and stagnation.

There is a middle ground:

Keep an emergency fund in cash

Invest the rest sensibly

Use ISAs and pensions tax-efficiently

Review regularly

Stay disciplined

This approach gives you:

Security today

Growth tomorrow

Dignity in retirement

You keep liquidity for short-term needs, while allowing the rest of your money to work for you.

The Bottom Line

Millions of Britons know inflation erodes cash.

Millions keep doing it anyway.

Not because it’s logical.

Because it feels safe.

But as the evidence shows, cash is often the slowest way to lose money.

Investing — done properly — isn’t about chasing quick wins. It’s about protecting your future purchasing power, building resilience, and giving yourself options later in life.

Or, as Kevin Brown puts it:

“Reluctance to invest is not just caution but a deep-rooted fear.”

Overcoming that fear isn’t reckless.

It’s responsible.

And for most people, it’s the single most important financial step they’ll ever take.

Follow the link to this short video by Martin Lewis, it’s powerful stuff!

Martin Lewis on Investing vs Cash

As always, if you have any questions about this piece or any other finance-related matter, please do not hesitate to contact me.

With very best wishes,

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner