Like many of you, I have been closely following the recent developments in Venezuela with a sense of unease. The speed and tone of events have prompted me to reflect not only on the immediate implications for markets and investors, but also on the broader direction of US foreign policy. In particular, the episode raises uncomfortable questions about how the United States engages with politically unstable, resource-rich regions—and whether similar dynamics could emerge elsewhere in the future, including territories such as Greenland.

With the above in mind, I was pleased to read the following very helpful summary of the position in Venezuela from LGT Wealth Management earlier this week:

“Venezuela, with President Nicolás Maduro now in US custody, is in crisis. The seeds of this apparent regime change trace their roots to 1999, when former President Hugo Chávez assumed power. The Chávista government enacted sweeping nationalisation of private industry and businesses, launched large scale social spending programmes, consolidated political power and aligned itself with nations such as Iran and Cuba. High oil prices between 2000-2015 bankrolled this self-styled Bolivarian Revolution.

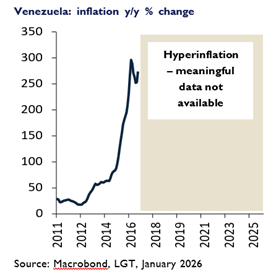

Hugo Chávez died of cancer in 2013, and Nicolás Maduro took over, keeping the same policies. By this point, the economy had collapsed under the weight of falling oil revenues, hyperinflation and geopolitical isolation. The state oil company, Petróle os de Venezuela SA (normally referred to as PDVSA) is reportedly run by the Venezuelan military and saw a major exodus of technically skilled engineering staff during the Chávez administration.

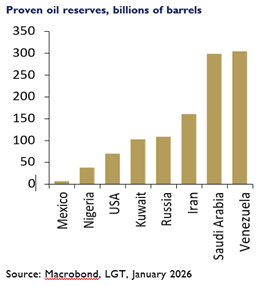

As such, it produces barely one million barrels of oil per day, despite Venezuela having the world’s largest proven oil reserves of 304 billion barrels equivalent. While having enormous potential as an energy producer, the fact that current production is so low is arguably why energy markets have not reacted in a meaningful way to the American intervention in Venezuela.

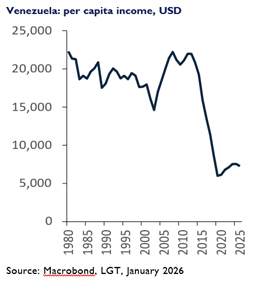

While the situation remains very fluid and we cannot speculate how the political situation on the ground in Caracas is going to evolve, we know that at least economically speaking, Venezuelans have endured extreme hardship, especially over the past 13 years where per capita income (as measured by the IMF) has dropped from USD 20,000 to only USD 7,250. That implies there would be a high appetite for economic change and new policies to stabilise prices and re -ignite growth. Who would helm that process and how long that would take is unclear.

A new kind of “realpolitik”

Given public statements from President Donald Trump, one conclusion is that the US is pursuing a unilateral, opportunistic strategy, especially when it comes to access to energy, be it fossil fuels or otherwise. One can imagine a scenario where US energy companies eventually step in and rebuild Venezuela’s energy sector, tapping untold large proven reserves.

That said, it would be naïve to assume that other global powers might not be motivated to act in an equal unilateral fashion, be it in energy, technology or other arenas. What this implies is that the coming years may see more assertive, interventionist behaviour by governments, not just the US. In the 19th century, this was referred to as “gun boat diplomacy” and is apparently making a comeback in the 21st century. The current version features modern weaponry and so called “hybrid warfare”, where combatant nations use a range of technologies and social media to undermine one another, without formal declarations of war. As a case in point, President Trump removed Maduro from power without consulting Congress or declaring war.

What does this mean for portfolios?

From an investment perspective, so far, the financial market’s reaction appears muted and contained. The US dollar has appreciated slightly, in line with its safe-haven status. On the fixed income side, US Treasury yields and credit spreads are also mostly unchanged. We note that major US oil companies and refiners have seen a boost to their share prices, arguably due to the market speculating that a revitalised Venezuelan energy sector will benefit the US most. Overall, the dust has yet to settle, and it may take time to ascertain a) who will take over from Maduro b) how this will happen and c) an understanding the scale of investment needed to repair the damage to Venezuela’s oil sector. If events unfold in a constructive manner, then we can assume an increase in global oil supply that could help lower inflation. Oil infrastructure suppliers would stand to gain substantially as well.

Geopolitics have become an increasingly important feature of investing in recent years, typically causing short-term dislocations. Investors have become more attuned to these, resulting in less skittish markets. Remaining invested through a diversified portfolio has been key to investor success and we continue to encourage investors to look past short -term noise and remain focussed on long-term investment goals.”

Author - Sanjay Rijhsinghani, Chief Investment Officer

As always, if you have any questions about this piece or any other finance-related matter, please do not hesitate to contact me.

With very best wishes,

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner